Define criteria, limits, and decision flows with adjustable parameters according to business needs.

Connects to various external (credit bureaus, public databases) and internal (own systems, databases) data sources.

Quickly assesses incoming data, applying risk, fraud, and compliance rules, generating a score or status.

Approves, rejects, or forwards for review based on the analysis in seconds.

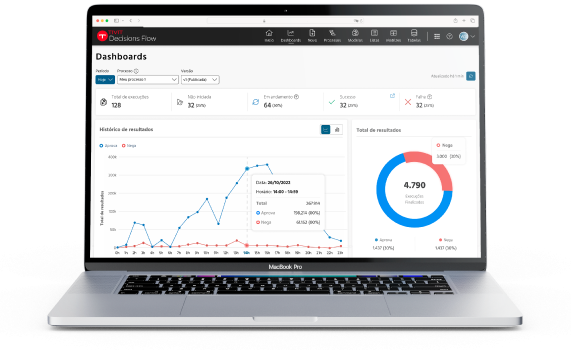

Monitors KPIs, generates reports, and enables instant adjustments to rules, continuously optimizing the process.